- 20/06/2025

- Economy and marketing

Figures for the first quarter of 2025 for the wood-furniture supply chain are in line with the trend of the same period last year, registering an overall -0.7 percent, with no substantial differences between the domestic market (-0.5 percent), which weighs just under 56 percent, and exports (-1 percent). “Data that we could call comforting,” says FederlegnoArredo President Claudio Feltrin, "given the international situation and the effects that overseas choices are having on our companies.

According to the Monitor carried out by FederlegnoArredo's Study Center on a sample of about 400 companies with sales of more than 2.2 billion euros in the first quarter of 2025, the furniture macrosystem, which accounts for more than 60 percent of total sales, closed the first quarter of 2025 with -2 percent, determined by both exports (-2.4 percent) and the domestic market ( -1.7 percent). Slightly better is the performance of the wood macrosystem: +1.9% total, +1.3% domestic market and +3.2% exports.

The difficulty of making forecasts

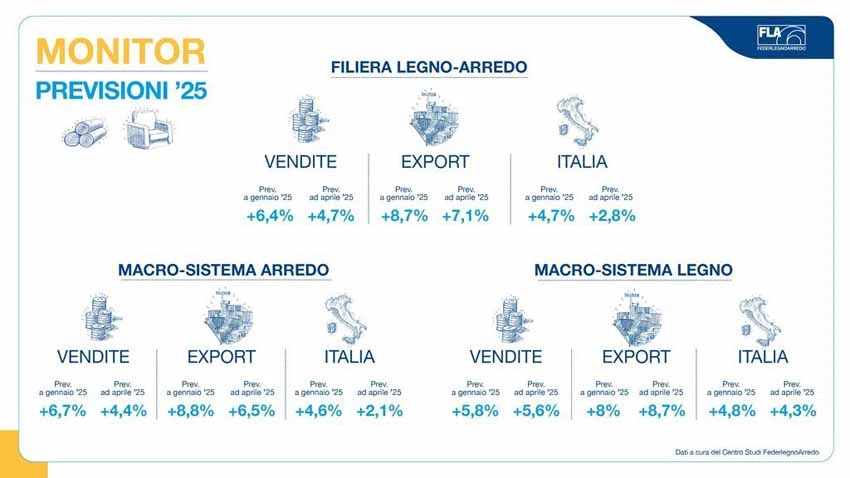

FederlegnoArredo's survey also wanted to ask members to venture a forecast for all of 2025 to understand the sentiment of the sector at a time dictated by uncertainty. Feltrin explained that those who tried to quantify the year-end revised it downward, compared to the previous survey, although maintaining a positive year-end, led more by exports than by the domestic market (+2.8 percent).

Forecasts at the beginning of 2025 identified a year-end of +6.4 percent for the industry, while now the percentage has dropped to +4.7 percent; for the domestic market, it goes from +4.7 percent to +2.8 percent, and for exports from +8.7 percent to +7.1 percent. In the furniture macrosystem, which is particularly devoted to exports, segment forecasts go from +8.8 percent at the beginning of the year to the current 6.5 percent.

“More than forecasts,” Feltrin argues, "I would tend to call them hopes, aware that, given the speed with which geopolitical scenarios change and with what force they impact companies' business from one day to the next, they are increasingly ‘short-lived’ readings.

Uncertainty dominates the future

Another extremely topical issue is that of tariffs. According to FederlegnoArredo's Monitor, just under half of the responding companies believe they may be impacted, and of these about half quantify it as 5 percent; 26 percent, on the other hand, believe it will have an impact of up to 10 percent, and the remaining 25 percent, state more than 10 percent. However, there are also those who are unable to make any kind of prediction.

“This is the most worrying figure in my opinion,” Feltrin concludes, "which testifies to the state of confusion and total uncertainty that has immobilized many companies, waiting to have a stable picture and decide on future strategies, starting with opening up to new markets or discovering potential ones.

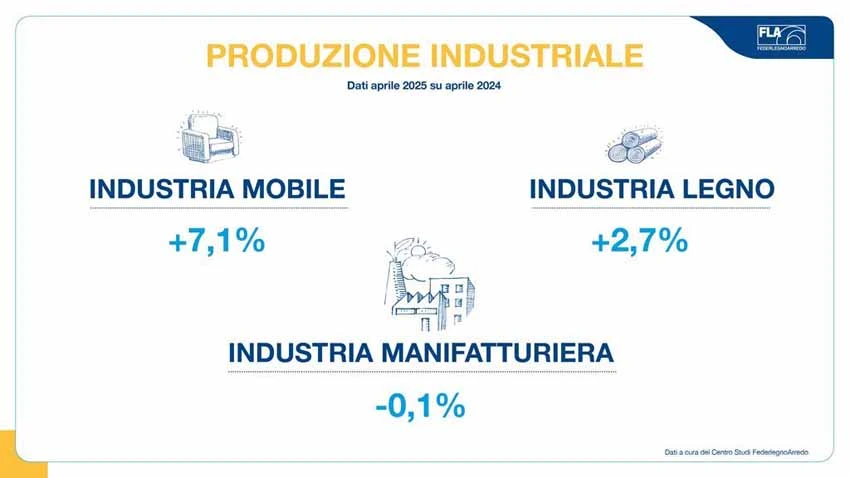

A glimmer of optimism comes from April's industrial production data, which sees the furniture industry mark +7.1 percent compared to April 2024 and the wood industry +2.7 percent, while the overall manufacturing trend is stationary (-0.1 percent).

en

en  Italian

Italian French

French German

German Spanish

Spanish Portuguese

Portuguese