- 02/02/2026

- Economy and marketing

According to the 2025 Preliminary Estimates prepared by the Study Center of FederlegnoArredo and presented on the occasion of the Salone del Mobile.Milano press conference, the wood-furniture supply chain closed 2025 with a production turnover of 52.2 billion euros, recording a 1.3% increase compared to 2024. Contributing to this result was mainly the performance of the domestic market, still supported by certain tax incentives linked to the redevelopment of the building stock which, with a stronger push from the non-residential sector, recorded a 1.8% increase, reaching 32.9 billion euros. Exports, on the other hand, are stable (+0.4%) at 19.3 billion euros (37% of the total): while still showing signs of weakness in some strategic markets such as France and the United States, these data reveal a slight recovery from Germany.

“Data that - comments the president of FederlegnoArredo, Claudio Feltrin - certify how our supply chain and the entire industrial system we represent, despite dealing with a complex, articulated and uncertain context, have been able to deploy strategies and adaptation and development actions that have translated into substantial resilience. We cannot say that we are facing a structural recovery nor that we can feel safe from the turbulences that 2026 is already reserving for us, but I want to see encouraging signals on which, also as a Federation, we have the duty to focus, supporting our companies”.

Furniture and wood macrosystem

The furniture macrosystem reaches a 2025 production turnover of 27.7 billion euros, substantially stable (+0.6%) compared to 2024. The growth in production destined for the domestic market (13.5 billion, +2.1%) offsets the slight decline in exports (14.2 billion, -0.8%), which continue to represent over half of the total value.

The wood macrosystem (including wood trade) grows by 2%, reaching a turnover of 24.5 billion euros. However, this figure is partly driven by price trends and a recovery in exports (5.2 billion, +3.8%). The domestic market (19.3 billion) records a +1.5%.

Exports: a substantial holding

Regarding foreign markets, the data from the FederlegnoArredo Study Center, updated to October ’25, show overall a trend of substantial holding, confirming the strategic weight of exports on the sector's results.

Of particular interest in the top 10 is Germany, which in the first ten months of 2025 returns to positive territory (1.7 billion; +1%), while France still shows weakness (2.5 billion; -1.3%) which, after the strong expansion in the '21-'22 biennium, slows down despite a slight recovery in recent months. The United States records -2.5% (1.7 billion), after the 2024 rebound, with monthly performance influenced by the anticipation of purchases in the spring months ahead of tariffs; this was reabsorbed in July, when the cumulative percentage change was still positive at +0.3%. In the following months exports slowed sharply, particularly in August and October.

Positive trends instead emerge toward some European and non-European markets, which help partially offset the decline in traditional destinations. Among the countries with the best performances in terms of value increase of exports are the United Kingdom (+4.2%), the Netherlands (+8.5%) and Spain (+2.3%), which reaches the fifth place in the Top 10 among destination markets, overtaking Switzerland. Markets such as the United Arab Emirates (+3.9%) are also growing.

“Overall - explains Feltrin - the picture that emerges is that of an export that maintains a central role for the supply chain, but that requires companies to have greater adaptability, market presence and diversification, in an international scenario characterized by high volatility”.

Increased checks on incoming goods

China, meanwhile, is gaining market share both in Italy and in Europe. “Just think – highlights Feltrin – that for the furniture macrosystem, after a very strong second half of 2024, the first ten months of 2025 also confirm the trend: +3.7% in Europe, -0.3% in Italy. Conversely, total imports fall by 7.7%, to the benefit of the share from China, which is progressively strengthening its competitive position in the European market, in a context of increasing pressure on Italian exports”.

For this reason Feltrin has launched an appeal for “greater checks to be carried out on goods entering our market, in order to avoid unfair competition from those countries that produce without respecting the rules to which European producers are subject”.

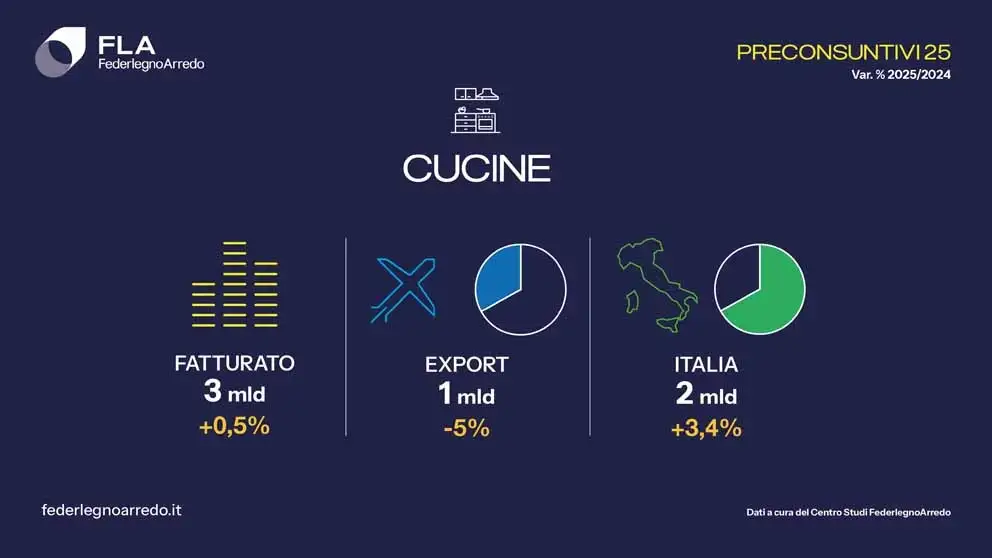

Kitchens: an overall stable picture

In 2025 the kitchen sector records a production turnover of 3 billion euros, substantially in line with 2024 (+0.5%), confirming an overall picture of stability after the three years of strong growth that characterized the post-pandemic period. Production destined for the Italian market grows by +3.4% (2 billion); conversely exports (1 billion) register a -5% decline, after years of particularly strong expansion. The slowdown in exports particularly affects some key markets, including the United States and France, while more dynamic signals emerge from countries such as the United Arab Emirates and Spain.

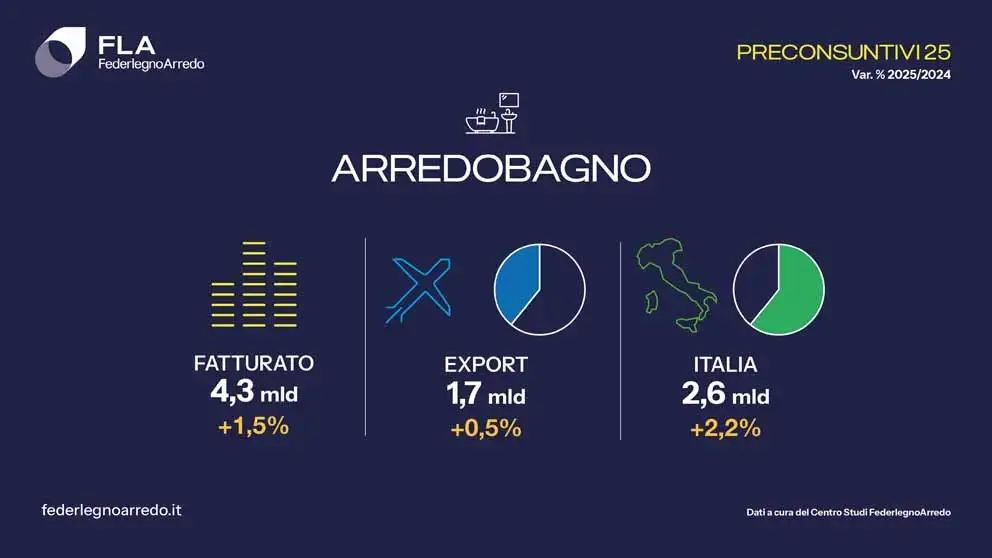

Bathroom furnishings: holding up well

In 2025 the bathroom furnishing system records a production turnover of 4.3 billion euros, with growth of +1.5% compared to 2024, confirming good overall resilience. The positive trend is mainly supported by the domestic market which grows by +2.2%, while exports remain essentially stable (+0.5%), nearing 1.7 billion euros, with an export share of around 40% of the total value. Signs of recovery from Germany, the main destination country, are evident.

en

en  Italian

Italian French

French German

German Spanish

Spanish Portuguese

Portuguese