- 16/06/2025

- Economy and marketing

CSIL, Center for Light Industry Studies, has released the World Furniture Outlook 2025/2026 Report, its flagship publication that provides, twice a year, an overview of global furniture industry trends, covering 100 countries, with an analysis of the current state and forecast of the world furniture market.

Industry trends in recent years

The CSIL Report starts by analyzing data from recent years to arrive at an outline of the current, somewhat uncertain situation and speculate on the international scenario in 2025/2026.

Over the past decade, international trade in furniture has grown more than global furniture production, accounting for about 1 percent of total international trade in manufacturing goods. By 2019, the trade value of the sector had reached about $151 billion. The outbreak of the pandemic in 2020 interrupted this upward trend, leading to stagnation. However, 2021 marked a period of strong recovery and growth, followed in 2022 by another year of stagnation. Data for 2024 indicated a modest recovery, with the value of international furniture trade rising slightly.

Uncertainty generated by tariffs

The outlook for global trade has deteriorated sharply due to soaring tariffs and trade policy uncertainty. In recent months, tariffs have been announced, suspended, renegotiated, reintroduced, and suspended again. In this changing environment, it is not only the tariffs themselves, but also the uncertainty they generate, that weigh heavily on global trade and investment decisions. Future prospects are negatively affected by the protectionist agenda of the new U.S. administration. As a result, world trade in furniture is expected to decline in 2025.

Diversifying outlet markets

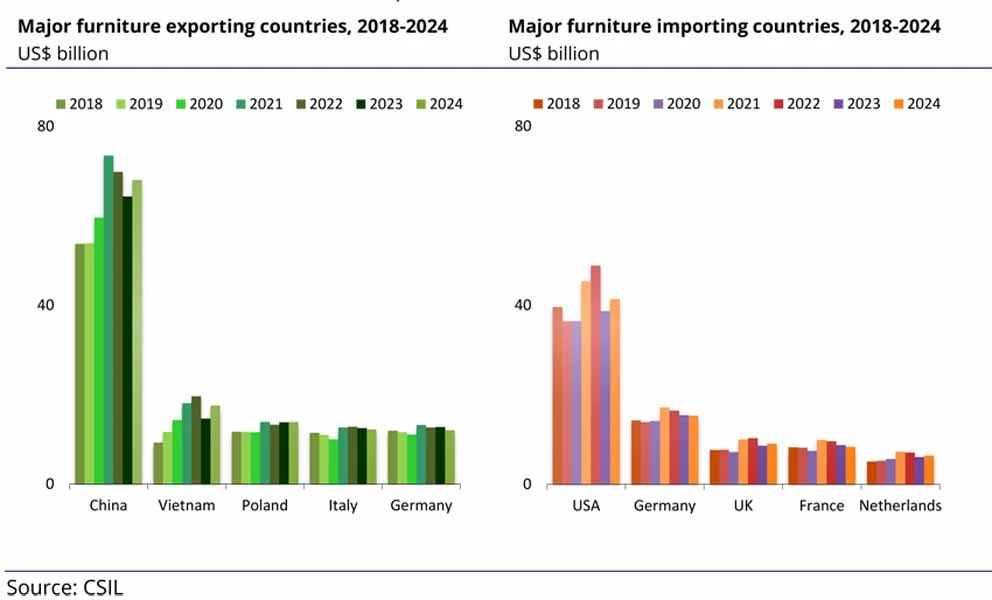

The leading furniture exporter is China, followed at a distance by Vietnam, Poland, Italy and Germany. After a sharp increase in 2021, China's furniture exports significantly decreased in 2022 and 2023, marking a gradual recovery in 2024.

According to CSIL data, the world's leading importers of furniture are the United States, Germany, the United Kingdom and France. U.S. imports account for about a quarter of the world's furniture imports, and of the 100 countries analyzed by CSIL, 24 list the United States as their main destination. Moreover, among these, 10 allocate more than 50 percent of their furniture exports to the U.S. market.

Uncertainty related to international trade policies could push countries to diversify their outlet markets; in particular, trade tensions between the United States and China could generate trade diversion phenomena, raising concerns in markets about possible intensified competition from Chinese exports.

Only in 2026 would a modest improvement

Evolution of world GDP. Annual percentage change in real terms.

Above is the international scenario according to the CSIL World Furniture Outlook 2025/2026 Report.

World GDP growth is projected to decline from an estimated 3.3 percent in 2024 to 2.8 percent in 2025, then rebound to 3 percent in 2026. These projections represent downward revisions from previous forecasts. The downgrades in different countries are mainly due to the direct impact of new trade measures, just as their indirect effects are a consequence of increased uncertainty in economic sentiment.

Reduced household purchasing power caused by inflation and high interest rates, tightening financing conditions, and uncertainties in the economic, social, and political environment affected furniture consumption in 2023 and 2024. In 2024, furniture consumption in dollars is almost back to the same level as in 2019. For the world as a whole (100 countries), furniture consumption is expected to remain almost unchanged in real terms in 2025, marking a modest improvement in 2026.

Amid uncertainty difficult forecasts

International furniture trade is going through an unprecedented period of uncertainty. Trade policies and the unpredictability of tariff measures may persist in the near future. Forecasts of international furniture consumption and trade should therefore be used with caution, particularly for countries where the furniture sector is more open to foreign trade. The continuation of such uncertainty negatively affects the economic climate of the industry, influencing the investment decisions and consumption behavior of households.

CSIL World Furniture Outlook 2025/2026 Report

June 2025, XXVIII edition, 161 pages

ùLanguage: English - €2600

en

en  Italian

Italian French

French German

German Spanish

Spanish Portuguese

Portuguese