- 07/01/2026

- Economy and marketing

The international furniture trade is in a state of uncertainty without precedent. The main cause of this uncertainty is the unpredictability of trade policies and tariff measures, i.e. tariffs, which appear likely to persist. This clearly emerges from the World Furniture Outlook 2026 Report, the publication of CSIL, in English, which provides an overview of the state and prospects of the global furniture sector.

The effects of tariffs in 2026

CSIL's preliminary estimates for 2025 indicate a very slight increase in global furniture trade compared with the previous year, in current US dollar terms; moreover, they emphasize how the effects of the tariffs, introduced in mid-October, will become evident in 2026, forcing a delay in recovery prospects. According to CSIL analysts, future prospects are therefore negatively influenced by the uncertainty of trade policies, which remains high in the absence of clear and lasting agreements between trading partners.

A widespread climate of uncertainty

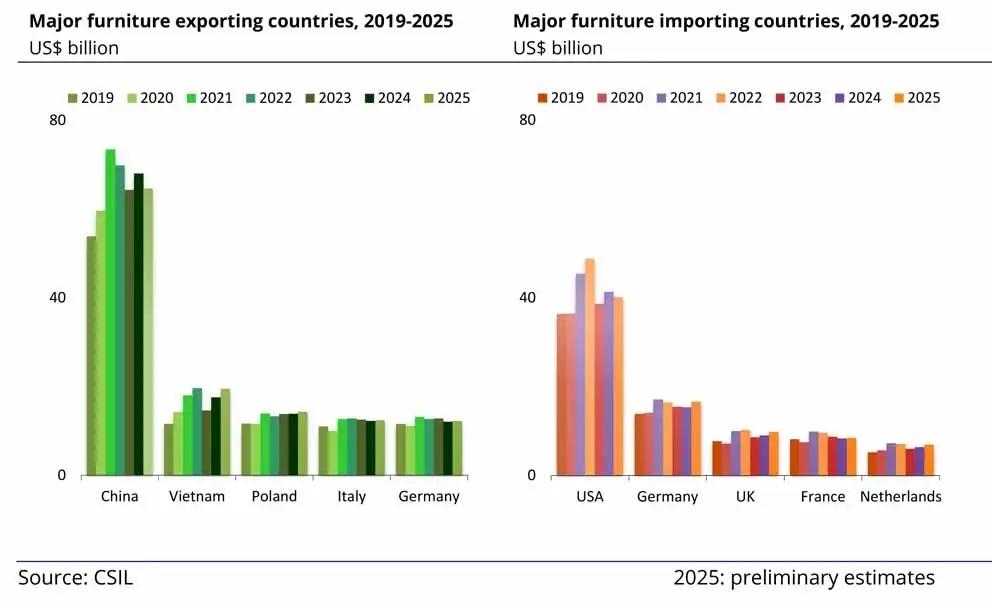

The trade landscape remains unchanged: the main furniture exporting country is China, followed at a distance by Vietnam, Poland, Italy and Germany.

After a strong increase in 2021, Chinese exports fell substantially in 2022 and 2023, with a partial recovery in 2024 that was however wiped out by the sharp decline recorded in 2025, which brought furniture exports back almost to 2023 levels.

On the other side, the main furniture importers are the United States, Germany, the United Kingdom, France and the Netherlands. The furniture imports from the United States amounted to 41 billion dollars in 2024, representing about a quarter of global imports. In 2025, the entry into force of the tariffs and, above all, the widespread climate of uncertainty led to a reduction in imports. According to preliminary estimates, European countries appear to be the best performers, although the data are expressed in current US dollars and are influenced by changes in the euro–US dollar exchange rate.

According to the CSIL World Furniture Outlook 2026 Report the international scenario will be as follows:

A new measurement tool

To better understand the situation, starting with this edition of the World Furniture Outlook Report, CSIL has for the first time introduced a new measurement tool, a vulnerability indicator, the Country Vulnerability Index/Furniture Export (FEXVI). The FEXVI is a composite indicator that assesses the external vulnerability of each country's furniture industry and quantifies susceptibility to external shocks by analyzing trade dependencies and competitive positions. High scores, up to 100%, indicate a high risk of external vulnerability, while low scores, down to 0%, suggest lower vulnerability. Currently, countries with the highest FEXVI scores also have a large share of exports to the United States.

Forecasts for 2026

As for the forecasts for 2026, which are very difficult to outline, the CSIL Report, based on IMF data, believes that global GDP growth will slightly decline, falling from an estimate of 3.2% in 2025 to 3.1% in 2026, but should then return to 3.2% in 2027.

The global economy is adapting to a context reshaped by new economic policy measures. Some excessive tariff increases have been mitigated thanks to subsequent agreements and recalibrations; however, the overall context remains volatile. Risks are tilted to the downside. Prolonged uncertainty, greater protectionism and labour supply shocks could reduce growth. Fiscal vulnerabilities, potential corrections in financial markets and the erosion of institutions could threaten stability.

Persistent uncertainty continues to negatively affect the economic climate in the furnishing sector, particularly regarding investment decisions by entrepreneurs and household spending behaviour. Therefore, after a difficult 2024 and 2025, global furniture consumption is expected to grow by about 1% in 2026.

en

en  Italian

Italian French

French German

German Spanish

Spanish Portuguese

Portuguese